Who We Are

American Veterans Group provides competitive capital market services to corporate and municipal issuers while driving measurable social impact. For issuers seeking more than a check-the-box approach, we offer a dynamic, results-driven alternative—one that aligns financial success with a commitment to lasting impact.

Our mission

As a service-disabled, veteran-owned securities broker-dealer, American Veterans Group maximizes its clients’ social impact and Corporate Social Responsibility goals by advancing clients’ veteran employment objectives.

What is a Public Benefit Corporation?

Many states such as Delaware have recently allowed innovative companies with a commitment for creating social good to incorporate as Public Benefit Corporations (PBCs). A growing number of companies such as Patagonia, Etsy, Kickstarter, and Jessica Alba’s The Honest Company, have incorporated as PBCs. AVG’s leadership believe its value proposition greatly aligns to that of a PBC and feel this corporate structure allows AVG to align itself to this growing corporate clientele. In reporting to its Board of Directors, the PBC must disclose its financial statements and its social impact statements to be audited by a third party firm.

Our Non-Profit Foundation Holds a 25% Ownership Stake in our Firm

Profits from our business are distributed to a non-profit (501c19) we created to help fund military veteran social efforts. Our value proposition to clients is, “the more business our firm does with you, the more social impact we can deliver to the military veteran initiatives that you (the client) care about.” Our foundation is presently a 25% equity owner of the business. We believe that our company is more valuable with this significant non-profit ownership and gives us the flexibility to fund initiatives in the local communities of our clients.

OUR SOCIAL IMPACT

We believe that the earnings of a successful business should be shared with the communities in which they operate. As a Public Benefit Corporation, the AVG Foundation holds a 25% ownership stake, ensuring our firm's mission extends beyond financial performance to serve the interests of veterans, active duty military personnel, and their families. American Veterans Group maximizes its impact by partnering with HR teams and Employee Resource Groups to help advance military veteran employment and helps our clients achieve their veteran recruitment, hiring, and retention goals.

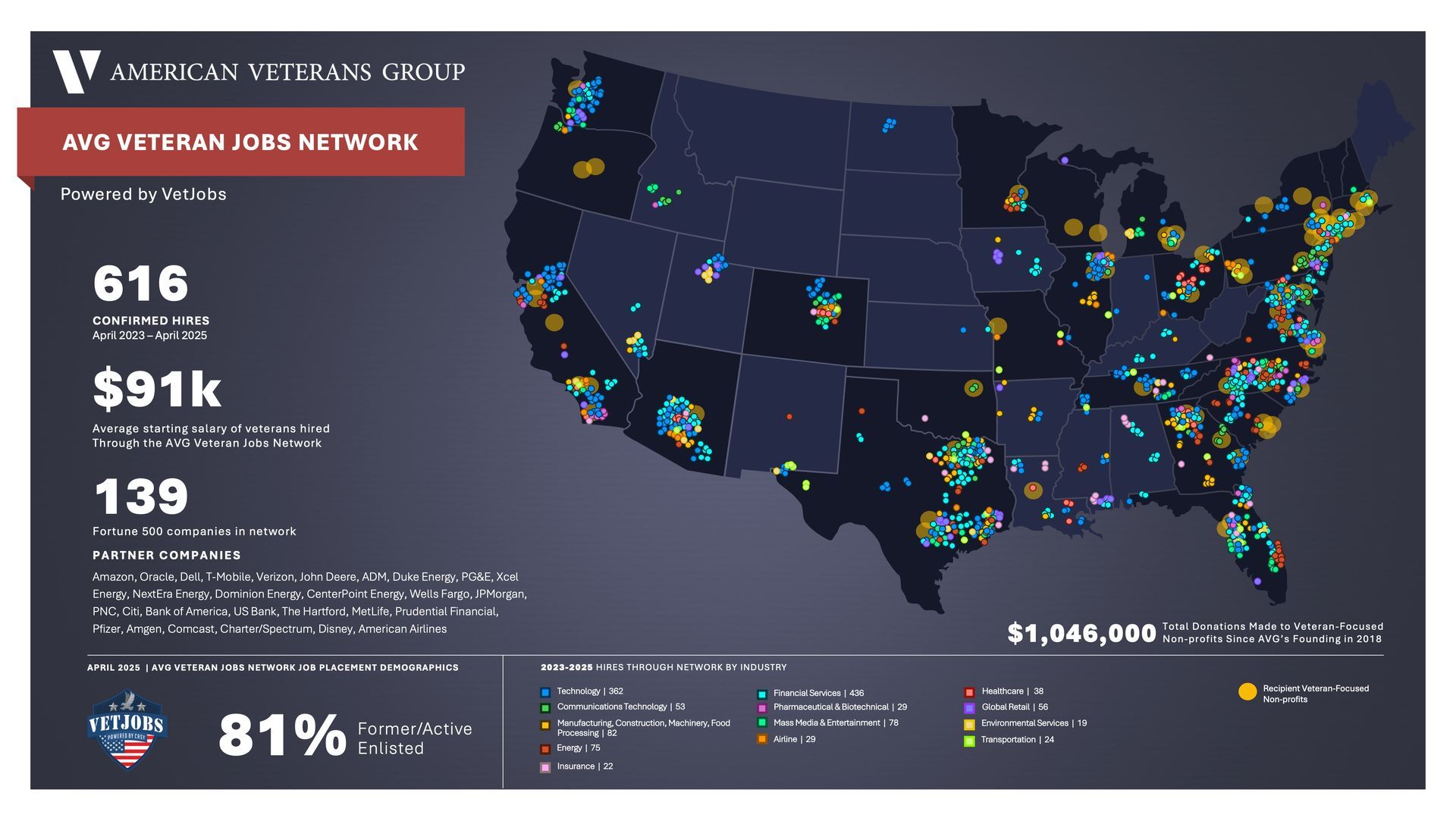

The AVG Veteran Jobs Network

The goal of the AVG Veteran Jobs Network, powered by VetJobs, is to improve employment and retention rates for military-affiliated employees and their families for American Veterans Group’s current and prospective client companies. The network also helps AVG’s clients improve veteran retention rates for military-affiliated employees by providing access to free industry-required training and certification programs. Through the AVG Veteran Jobs Network, AVG’s client companies can advance their veteran hiring and retention efforts, furthering their own social impact initiatives.

our story

Ben Biles and his best friend and U.S. Naval Academy roommate dreamed of working together on Wall Street after completing their required military service. Sadly, the hardships faced with transitioning from the service changed that dream.

Just weeks after leaving the Navy, Ben’s friend Keith took his own life. Keith’s story has unfortunately become more common with a growing number of post 9/11 veterans returning home and facing the hardship of PTSD and depression. Ben shifted course to honor Keith’s legacy by building a business to serve veterans and add value to our country.

In this pursuit, he joined forces with his mentor and industry leader Bill Frazier to add deep experience and a track record of business and professional excellence. As an American military veteran united with a Wall Street executive, they formed American Veterans Group. We believe the values honed through military experience provide an edge when it comes to delivering the excellence our clients expect.

our team

Leadership

Ben Biles

CEO & Chief Compliance Officer

Ben sets strategic policy at American Veterans Group and leads both business development and social mission development. He advises investment managers, corporate finance professionals, and community leaders on ways to advance their financial and social goals. Ben is active in veteran social issues and is committed to well-managed, stakeholder-conscious, and well-governed companies.

William Frazier

Co-Founder

William brings over 45 years of comprehensive experience to American Veterans as a leader in business and non-profits. Before co-founding American Veterans Group, William served as managing partner at Gates Capital Corporation where he oversaw a team of 30 investment professionals dealing with institutional business in all asset categories. Prior to Gates Capital Corporation, he was co-head of global fixed income at Oppenheimer & Company. During his 20- year tenure at Oppenheimer he successfully grew the Fixed Income business to be a leader in the industry, Early on in his career, William was head of Municipal Trading at JP Morgan.

Jared Kurtzer

Managing Partner

Jared has 20 years experience in fixed income management, sales and trading, underwriting, and risk management. He joins American Veterans Group from Gates Capital where he served as managing director. Prior to Gates Capital, he was involved in municipal underwriting as well as municipal and taxable fixed income trading and sales at Prudential Securities. Jared has worked on both the institutional and retail side of trading and sales.

Frank Baxter, Managing Director

Frank has over 20 years of experience in the financial services industry. He comes to AVG from BTIG Financial Services where he served six years as a director and institutional sales trader covering institutional accounts on the firm's high-touch cash desk. Prior to joining BTIG, Baxter was director of institutional sales at GMP Securities and held similar positions at Convergyx, Dahlman Rose & Co., Knight Capital Group LP, and Dillon Read.

Michael Bohling, Associate

Phil Culpepper, Managing Director, Public Finance and Municipal Banking

Phil Culpepper joined AVG in September 2023 as the head of its Investment Banking team and has nearly 20 years of finance experience. Phil started his career serving in various roles in state government with a focus on municipal finance and project finance. He served as the Deputy Executive Director/Chief of Staff of the Illinois Housing Development Authority, the Director of Debt Management for the State of Illinois (GOMB) and as a financial/bond analyst for the Illinois Tollway. During his tenure with the State of Illinois and its authorities, he has led the issuance of over $15 billion in bond and derivative transactions. After leaving state government in 2010, Phil joined an industry leading Hispanic-owned investment bank as the Head of Midwest Operations and was their lead banker on approximately $87 billion in primary market offerings until his departure in 2022. Prior to joining AVG, he was the Head of Municipal Finance for a small disabled veteran owned investment bank.

John Dagher, Senior Vice President

John has over 30 years of experience in the fixed income markets. He has worked in a variety of roles, including trading cash, futures, and covering institutional accounts. His role with AVG is to serve our institutional client base in the distribution of fixed income products with a focus on the municipal market. John previously worked at Keybank for 10 years, where he was a Director in Institutional Sales with a focus on bond funds, trust departments, and TOB accounts. Prior to joining Keybank, he served as a director in the municipal bond department at RBC, where he worked for over 15 years.

Mike Elia, Senior Vice President

Michael has over 20 years of experience in the financial services industry. He joins American Veterans Group from Drexel Hamilton where he served as Vice President of Global Equity Trading. Prior to Drexel Hamilton, he was the Director of Prime Services Trading & Relationship Management at Victor Securities. Michael spent over 10 years managing hedge fund relationships within prime brokerage. He also traded international equity and managed a trade support desk at UBS for five years. He started his career at Morgan Stanley working in equity and fixed income operations.

Steve Elias, Senior Vice President, Municipal Bonds

Steven brings more than 50 years of experience in the trading and marketing of both primary and secondary municipal bonds to American Veterans Group. As the former President and CEO of Municipal & Government Securities Corporation of New Jersey, he is well versed in all aspects of the fixed income industry. His knowledge of both the retail and institutional business and overall reputation are his strong points.

S. Elias, Jr., Senior Vice President

Ekele Erondu, Director, ABS Banking

Ekele has more than 10 years of expertise in investment banking, capital markets, structured finance, and securitization. Prior to joining AVG, he was Vice President of Capital Markets for Performance Trust Capital Partners, which offers a wide range of financial advisory and investment banking services for financial institutions. He also served in a capital markets role for Southern California Edison and was a whole loan trading and investment associate for MetLife Investments. He has an MBA in finance and economics from Carnegie Mellon University.

Jose Franco, Director

Tom Guinan, Senior Vice President

Robert Henry, IT and Cyber Vendor

David McClean, Compliance Consultant

Frank Mena, Senior Vice President

Prior to joining American Veterans Group, Frank founded Points North Capital, where he ran a long/short equity book and global investment grade portfolio. A veteran of the United States Marine Corps Infantry, he served five and a half years before being medically retired as a Sergeant from Walter Reed Medical Center in Bethesda, Maryland.

Jeff Molinari, Senior Vice President

Jon Nixon, Financial and Operations Principal

Brad Pitcher, Senior Vice President

John Salter, Senior Vice President

With over 30 years of experience, John has driven sustainable revenue growth and directed regulatory compliance and fiduciary oversight for billion-dollar, international brokerage and investment management firms in California. He is highly adept at identifying and resolving potential issues, establishing and growing new branches, securing growth opportunities, performing due diligence, building high-performance teams, and fostering beneficial client relationships. His broad-based expertise includes strategic planning, risk management, deal origination, trading, securities, municipal tax-exempt bonds, derivatives, and asset and portfolio management.

Matt Sanders, Senior Vice President

With over 30 years of experience, John has driven sustainable revenue growth and directed regulatory compliance and fiduciary oversight for billion-dollar, international brokerage and investment management firms in California. He is highly adept at identifying and resolving potential issues, establishing and growing new branches, securing growth opportunities, performing due diligence, building high-performance teams, and fostering beneficial client relationships. His broad-based expertise includes strategic planning, risk management, deal origination, trading, securities, municipal tax-exempt bonds, derivatives, and asset and portfolio management.

Mike Stebner, Senior Vice President

Michael has over 20 years experience in the financial services industry. He joins American Veterans Group from Gates Capital. where he worked for over a decade. While at Gates Capital, he rose to be the firm's senior trader, specializing in fixed income products including Municipal, Corporate, MBS, Government Agency, CD’s and High Yield Securities. Prior to Gates Capital, he worked for Charles Schwab's Northeast Trading Desk, was a Vice President of Investments at First Empire Securities, and was an Investment Specialist for Dreyfus.

Ledice Sweeney, Senior Vice President

Ledice has over 25 years experience in the financial services industry. She started her career at Oppenheimer & Co. in Latin America securities. She moved on to Dillon Read where she committed capital trading arbitrage in ADRs and ordinary securities for the international department. She moved on to the US equity department as a Sales Trader for the remainder of her career. She worked in large institutions including UBS, Bank of New York and Griswold a direct access floor broker for the NYSE for a number of years. Her coverage included institutional investors, pension funds, and money managers along with corporate Buybacks at the Williams Capital Group.

Jerome Vicidomine, Senior Vice President

Jerome began his career as an intern at Points North Capital. This role included learning the operations process, debt and equity trading, as well as equity capital markets. Prior to joining the private sector, Jerome served eight years as an infantry Marine in the United States Marine Corps. His service included three overseas deployments to the Middle East, South East Asia, and Scandinavia.

AVG Careers

If you are dedicated to providing outstanding service while making a meaningful impact on the veteran community, American Veterans Group wants to hear from you.